Almost everyone has a picture in their head of how their lives should run. It typically goes  something like this: Your living space is orderly and tidy, with carefully chosen containers and efficient ways to house your belongings. Last minute guests? No biggie. Your place always looks ready to entertain friends and family. Your finances are in good order and you live within your means, making wise choices about how you spend your hard-earned money. You monitor your bills and make sure every charge is legitimate and every payment is on time. You are on top of your schedule and never need to rush out the door. And - hey look! - there are your keys/wallet/purse/phone in a dedicated space where they are always waiting for you to you grab on your way out.

something like this: Your living space is orderly and tidy, with carefully chosen containers and efficient ways to house your belongings. Last minute guests? No biggie. Your place always looks ready to entertain friends and family. Your finances are in good order and you live within your means, making wise choices about how you spend your hard-earned money. You monitor your bills and make sure every charge is legitimate and every payment is on time. You are on top of your schedule and never need to rush out the door. And - hey look! - there are your keys/wallet/purse/phone in a dedicated space where they are always waiting for you to you grab on your way out.

OK, so this is just a fantasy, right? What’s the matter with a little clutter and disorganization? What’s the big deal about sometimes forgetting or losing stuff? Well, it’s not really a big problem when you just experience the snippets of day to day difficulty you encounter. Take care of it and forget about it, right? Move on, as they say. But if you take a step back and use a wide angle lens on these daily annoyances, you might discover there’s actually a big cost to not having good systems for running your life. And there’s not just an emotional cost of those accumulated frustrations - there’s a cost of the real dollars and cents variety that may surprise you if you look back on the last year.

What Can Ineffective Habits Cost You in a Year?

Let’s look at a few examples of what expenses you could incur over the course of a year:

Car expenses

- Scrambling to make that dentist appointment on time, you may have gone a few miles per hour over the speed limit in that thickly settled zone. Speeding ticket: $175

- 20% rate hike in car insurance, surcharge for the next 3 years: $600

Household

- Can’t find that warranty paperwork on your new (and broken) vacuum cleaner: repair $40

- Expedited replacement fee for your passport that slipped inside an old notebook and got thrown out: $205

- Forget to turn down the heat when you leave for a 10-day ski trip: $97

Belongings

- Lost phone: if no insurance $600

- Misplaced the remote lock keyfob for car: replacement by dealer $245

- Lost coats, water bottles, sweatshirts and sneakers at the gym: $325

Hidden expenses

- The trial subscriptions to services that run out and charge your credit card on file: $120

- Missing out on early bird pricing for events during the year: $100

Fees and penalties

- Didn’t file taxes in time: late penalties $35

- Water bill that you totally forgot about: $15 late fee

- Need cash now but forgot to pop by your bank: ATM fees $36

How Much is Your Time Worth?

In addition to this itemized list above, think of adding up all the time you’ve spent in the last year searching for lost items, arranging for replacements of ATM cards or other life essentials that were misplaced or forgotten. Was it an hour? Or was it several hours - or even days as you add up all the time spent on hold with customer support or rooting around for that missing document or those dress shoes?

Long Term Financial Consequences

Then there are the other, longer term consequences to consider. If a pattern of late payments for your bills emerges, your credit rating can suffer. Maybe that prevents you from getting a loan for that business you wanted to start or results in a higher interest rate on that new mortgage. You’ll be paying more for your house than expected, costing you potentially thousands over the lifetime of that loan. In your professional life, you may miss out on promotions if you can’t get reports in on time because you’re procrastinating or perfecting them. Or maybe chronic late arrivals to work put you at risk for termination. Perhaps you can’t follow through on submitting an application for a new job you’d like better. All of these scenarios involve potentially significant financial losses.

Some Solutions to Consider

If by now you’re convinced that you need to get some systems in place to help your life run less expensively, here are a few things you can do:

- If your finances are in good shape, and you are not in danger of overdrawing your account, enroll in autopay or electronic payments whenever possible for bills like utilities and insurance. Electronic payments save you time and postage and eliminate the clutter associated with paper billing.

- Investigate an app like Truebill that finds and cancels subscriptions that you didn’t know you were paying for.

- Embrace google calendar (or some other electronic calendar). Put in recurring events for bills like credit cards, where the total fluctuates and you do not have autopay set up. If you have your Visa bill due on the 24th of the month, enter it in red on that day, in all caps. Then set up reminders for 3-4 days ahead of time so you can set up electronic payment in time. For appointments that you put in your calendar, enter a “leave by” time with reminders that pop up on your phone, to prevent a mad dash out the door.

- Establish a specific spot for your essentials like keys, wallet, sunglasses, purse, and phone. Maybe it’s a small basket or a dedicated shelf near the door.

- Establish a weekly, non-negotiable time to clean and organize your place. Consider pairing that with listening to an inspiring Pandora or Spotify playlist, or rewarding yourself with a fun activity when you’re done. Get folders and label them for categories like owner’s manuals and warranties, important documents like birth certificates and passports, utilities, etc. and then file new items on a weekly basis.

Change One Thing at a Time

It isn’t easy to change old habits, even when you know they’re costing you time and money. Your best bet is to change just one thing at a time. Take a look at the suggestions above and start with the one that you think will be easiest to do. Be patient with yourself and stick with this new way of doing things until it becomes automatic. Now, you’ll have the confidence to tackle a solution that seems a little harder to implement. With each gradual change you make, you’re establishing new, effective habits that will save you money and time in the long run. Isn’t it time for a change?

Photo above by Sharon McCutcheon on Unsplash

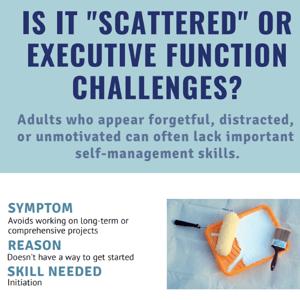

Download our infographic that describes 5 symptoms of Executive Function challenges in adults.